• What to look for? • Strike Selection & Ratios • SL mgmt • Avoiding freezes • Monthy Expiry • Event days

• How he would have traded last expiry?

Edward de Bono says intelligence is like a Automobile “A powerful car may be driven badly. A less powerful car may be driven well. The skill of the car driver determines how the power of the car is used.”

Automobile “A powerful car may be driven badly. A less powerful car may be driven well. The skill of the car driver determines how the power of the car is used.”

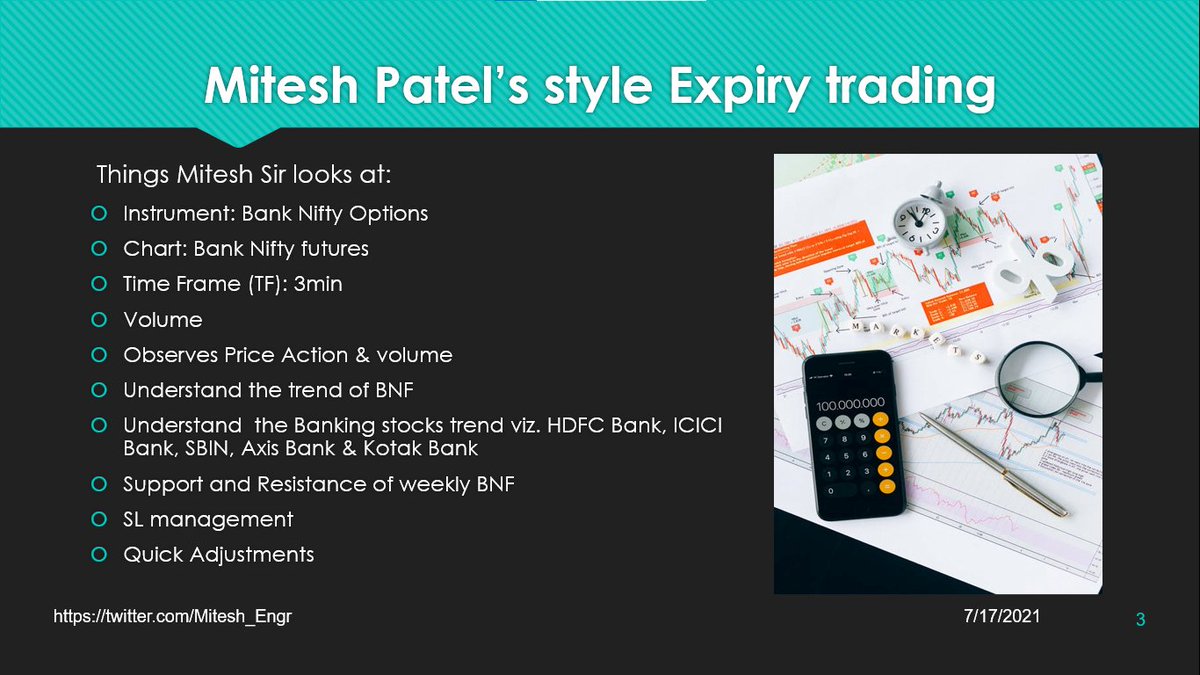

What Mitesh_Engr Sir looks at for Expiry Trading:

• Technicals of BNF

• Individual Heavyweight stocks of BNF

• Support/Resistance of BNF on weekly TF

• Also has Superb SL management

• When it comes to adjustments, he is always on toes

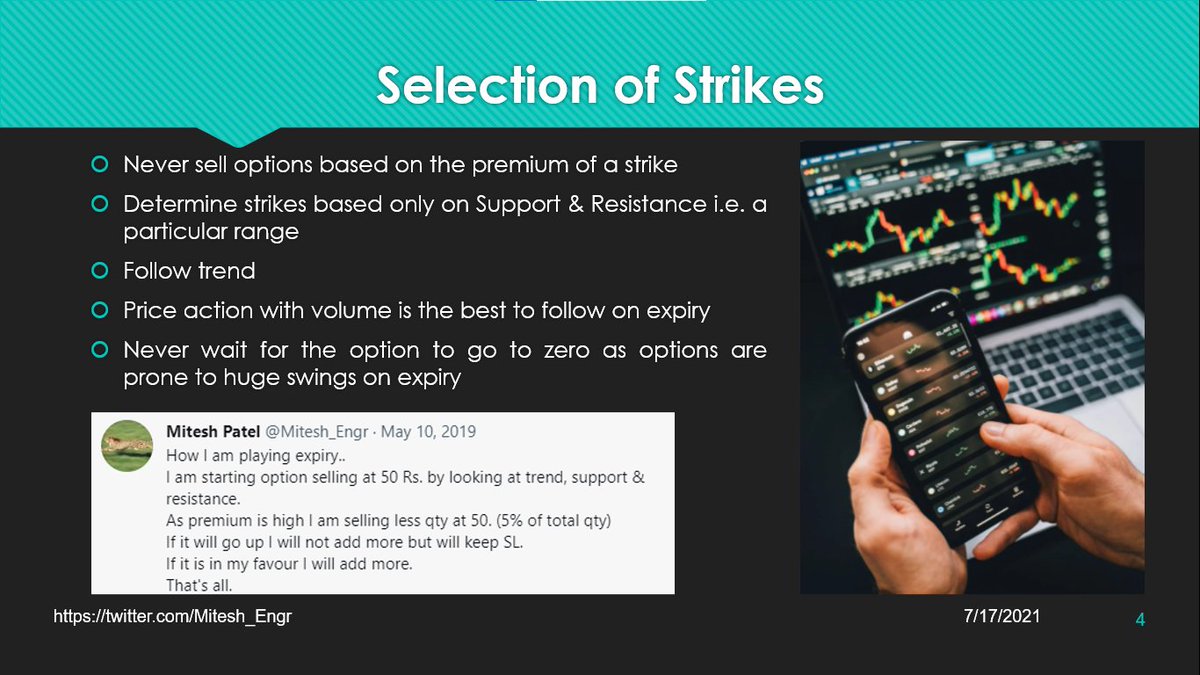

How to Select Strikes to Sell? • You can’t sell based on premium • Follow only trend • Price action is best to sell on expiry day • Never wait for the options to go to zero

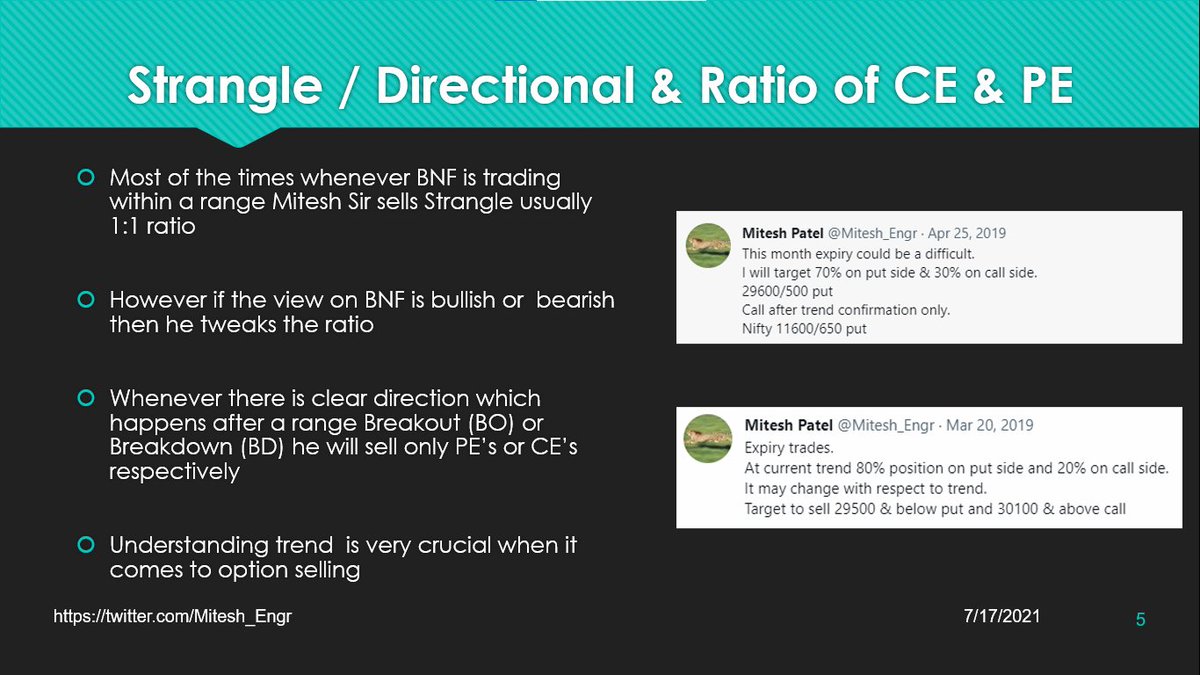

Using Ratios to Sell: • If BNF is in a range then strangles • If breakout/ breakdown from a range then directional • Selling 70/30 or 80/20 ratios • 2 examples on how he used ratios

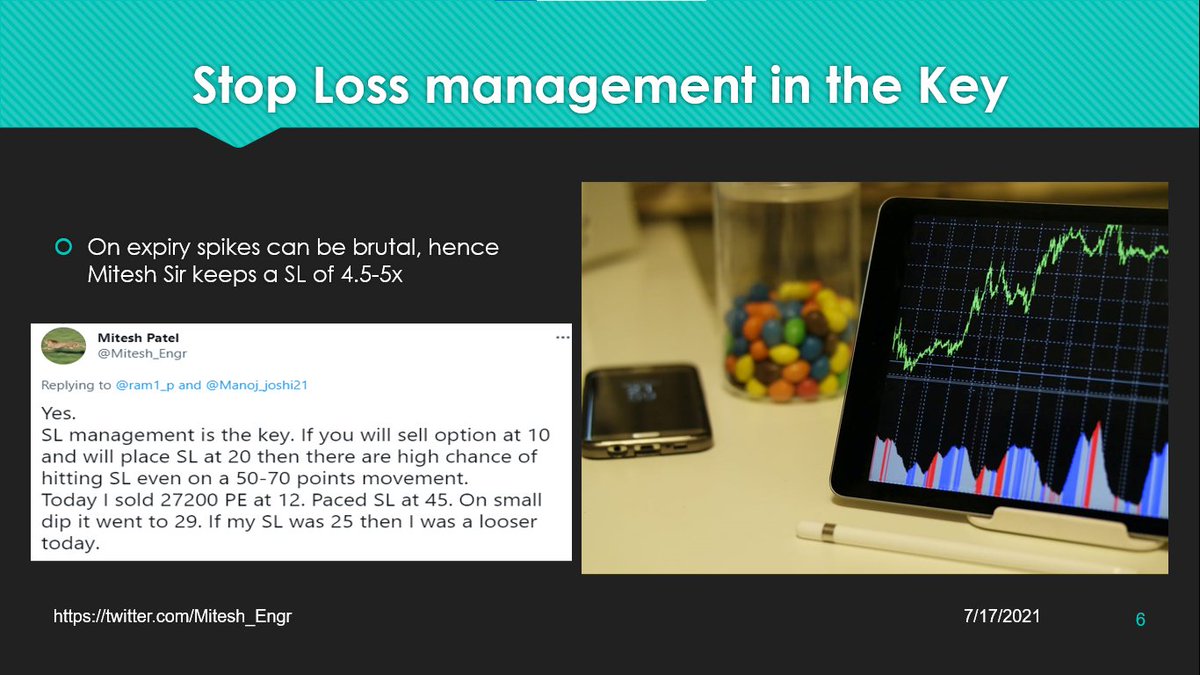

Stop Loss Management: Logical explanation given by @Mitesh_Engr Sir on how to manage stop losses • SL shouldn’t hit easily given the spikes on expiry day • High probability of success • Don’t lose huge in a violent move

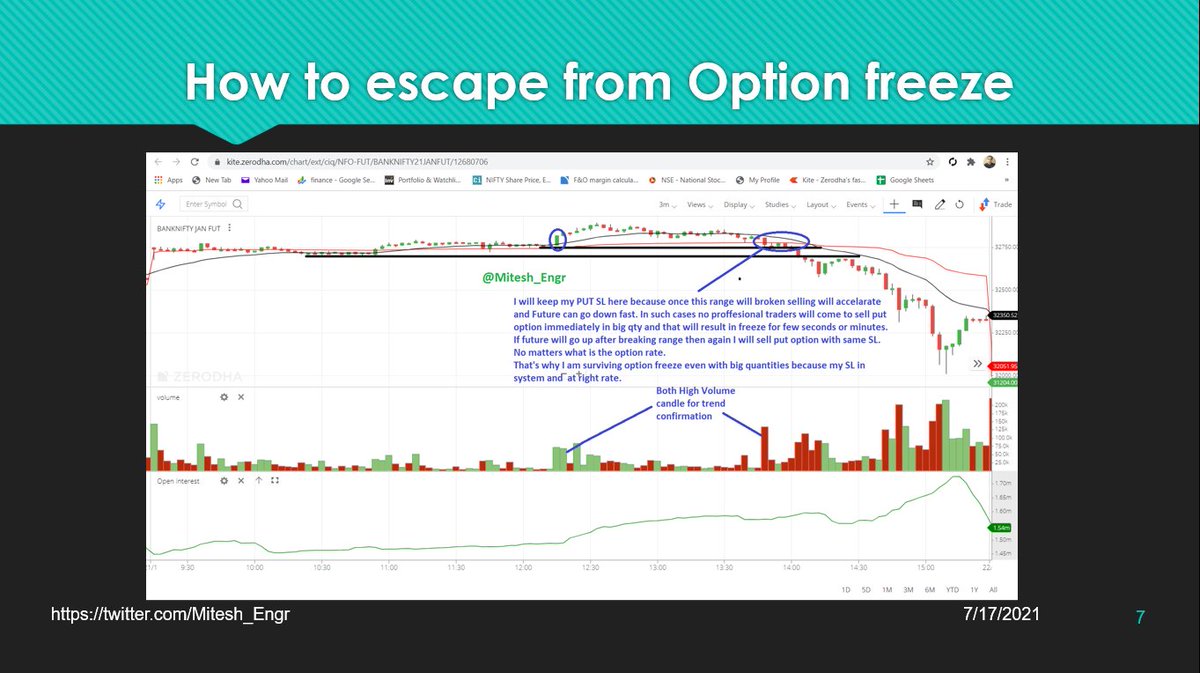

Excellent explanation on how to avoid an option freeze on an expiry day: • Keep Stop loss below range • Exit when hit • Re-enter when index enters range

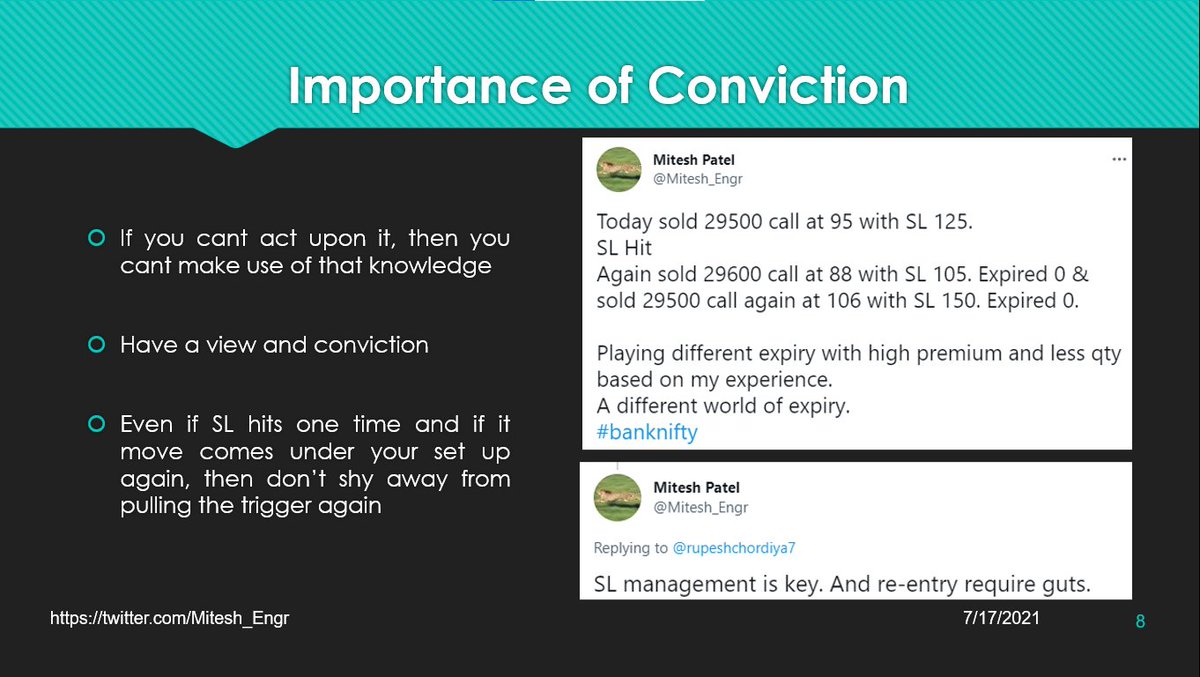

Conviction: • Ability to take re-entry multiple times

• High premiums

• Limited qty

• High profit

• Don’t sell Rs. 1-3 options

• Sell higher premiums and book them at Rs. 2-5 Have added an example of how he had conviction on a particular expiry day

Monthly Expiry: • Never assume option writers will defend their positions • They are already expired • Play according to day trend • No prediction

How to play expiry if knitted with Events: • No expiry view ahead of the event • Take decision post the event • Look at price action to see where chances are based on certain levels • Risk would lower as we’ve avoided the volatility

What @Mitesh_Engr Sir has to say on low premium selling on expiry day:  • Sell lower premiums high probability • Repeat multiple times • Lose heavy one time • Risk reward is unfavorable • Classic case of eating like a chicken & shitting like an elephant

• Sell lower premiums high probability • Repeat multiple times • Lose heavy one time • Risk reward is unfavorable • Classic case of eating like a chicken & shitting like an elephant

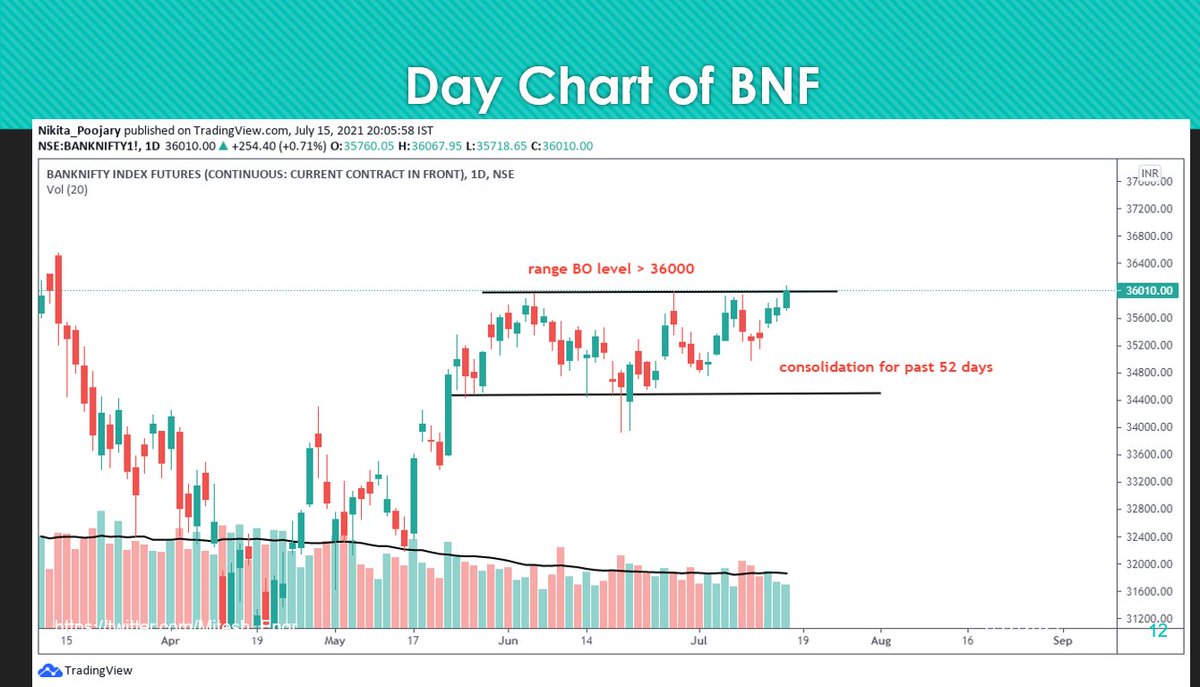

How to play last Thursday’s Expiry? (15th July 2021) • Daily chart shows ready for breakout • Derived supports on hourly charts

Through explanation as to how @Mitesh_Engr Sir plays intraday on expiry A detailed explanation on last Thursday’s Expiry given below: Please go through it to absorb better

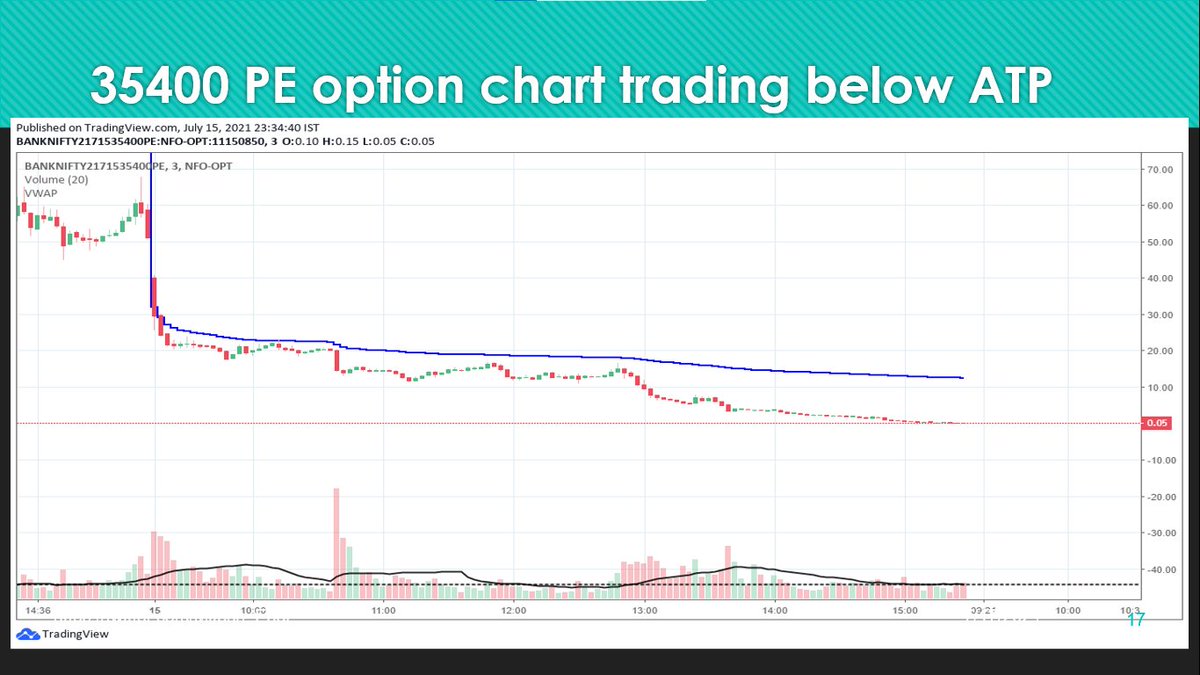

Put option charts of last Thursday • All Puts trading below ATP • All strikes were supports or below it

Call Option charts of last Thursday • Trading below ATP after 13:00 hours • 36000 was a resistance • Calls above it expected to be zero

This was a thread on how @Mitesh_Engr Sir trades on expiry day.