In the late 19th and early 20th centuries, few figures loomed as large over the American landscape as John D. Rockefeller. As the founder of the Standard Oil Company, Rockefeller not only built a business but also fundamentally reshaped the American economy, leaving behind a legacy that remains both awe-inspiring…

Why Chasing “Quick Wins” in the Market Feels So Good — And Why It Usually Costs You

One of the timeless lessons in investing is this: markets have a way of tempting you into the very behaviour that destroys your returns. Long-term compounding gets overshadowed by short-term excitement. Patience gets replaced by the adrenaline rush of daily swings. This isn’t new. What’s new is how easy it…

Best Option Buying Strategy in Sensex

This is the exact strategy I used to spot the big move in Sensex 84400 CE from 100 to 263: 1. When the market is in a strong trend before weekly expiry, on the weekly expiry day trend can reverse sharply and trap traders on the wrong side. 2. So,…

The Science of HittingTed Williams, John Underwood

We try to exert a Ted Williams kind of discipline. In his book The Science of Hitting, Ted explains that he carved the strike zone into 77 cells, each the size of a baseball. Swinging only at balls in his “best” cell, he knew, would allow him to bat .400;…

What is Buffett’s Strike Zone ?

Buffett and baseball. When Warren Buffett invests, he invests in opportunities that come in his ‘strike zone’. “The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you…

Mitesh Patel Trading Strategy by Alok Ranjan Official

Mitesh Patel is a well-known Indian options trader recognized for his aggressive yet disciplined trading style, particularly in the Futures and Options (F&O) segment, with a focus on Bank Nifty options. Below is a detailed overview of his trading strategy based on available information from web sources and posts on…

Safe Options Trading Strategies in an HFT-Dominated Environment

Given the Jane Street manipulation tactics and widespread HFT activity that now dominate Indian derivatives markets, retail options traders must adopt defensive, conservative strategies to participate while protecting their capital safely. Here’s a comprehensive guide to trading options safely in this challenging environment. ### Understanding the New Market Reality The…

Summary of Book “Engines That Move Markets”

The book indeed originated within Templeton as an in-depth study of the impact that the great technological inventions of the past 200 years—from the railways to the Internet—have had on financial markets and investors’ fortunes. It began just as the great stock market bubble of 1999-2000 was reaching its peak…

Power Of Compounding in Option Trading in India

Playing nifty one lot per lakh and making 100 points a month, i.e 1200 points a year, can make us 50*1200 = 60,000/- per annum with 1 Lac of capital. So basically, we can get 60% return per annum with just 100 points per month on an average basis. if…

Why so Much Hate on Sip or Mutual Funds? is it really Bad ?

So much hate on SIP so much hate for mutual funds. It’s not new, in every bear market it happens which is natural. Sad is when people who are at a good level and have good very good followers start misquoting it day and night. Please understand – SIP is…

What separates amateur traders from the pros? How did you know you finally got it?

A professional trader is not the one who has more trading screens, better equipment or the better indicators. A professional trader is defined by how he approaches his trading mentally and how he manages his trading routine day to day. Therefore, every amateur trader is a typical opposite of the…

Why Dow Jones is Down Today ?

In the current market climate, as depicted by the search results, several key themes are consistently contributing to market volatility and downward pressure. Here’s a breakdown: 1. Trade Policy and Tariffs: 2. Economic Uncertainty and Recession Fears: 3. Interest Rates and Monetary Policy : 4. Specific Sector and Company Performance:…

The Fall of Tupperware: A Cautionary Tale of a Brand’s Decline

Tupperware, once a household name synonymous with innovative food storage solutions and a thriving home-based sales model, recently filed for Chapter 11 bankruptcy. This iconic brand’s downfall serves as a cautionary tale for businesses that fail to adapt to changing consumer preferences and market dynamics. A Legacy of Innovation and…

The Margin of Safety: A Cornerstone of Value Investing

In the volatile world of investing, where emotions often trump reason, the concept of “margin of safety” stands as a beacon of prudence. This fundamental principle, championed by legendary investors like Benjamin Graham and Warren Buffett, emphasizes buying assets at a significant discount to their intrinsic value. What is…

Finding the Bottleneck: A Powerful Mental Model for Improvement

In any system, whether it’s a manufacturing process, a software project, or even your daily routine, there’s always one critical point that limits overall performance. This limiting factor is known as the bottleneck. Identifying and addressing bottlenecks is crucial for significant improvement, and the concept itself forms a powerful mental…

Finding Balance: The Mental Model of Equilibrium

The concept of equilibrium, a state of balance or stability, is a powerful mental model with applications across various domains, from the natural sciences to social systems. This model helps us understand how systems function, how they respond to change, and how to maintain a desired state. Understanding Equilibrium At…

The Power of Feedback Loops: A Mental Model for Growth

In the ever-evolving landscape of personal and professional development, understanding the concept of feedback loops is paramount. This powerful mental model provides a framework for continuous improvement by highlighting the cyclical nature of cause and effect. By recognizing and harnessing these loops, individuals can accelerate their learning, optimize their performance,…

“Charlie Munger 2023 Annual Meeting”

In 2016 I made a personal commitment to transcribe every Daily Journal Annual Meeting so long as Charlie was graciously hosting them. It’s been a privilege to attend each meeting and spend the time deep into the talks transcribing each sentence. Charlie will be dearly missed. Intro It was a…

What Can I’ve Learned from Bernard Baruch about Investing

Bernard Baruch is one of the most legendary characters in the history of investing. In his biography, Jim Grant writes that Baruch was not as wealthy as most people imagine, but rich enough to live the lifestyle “of a millionaire” (whatever that means). At various times in his life, Baruch…

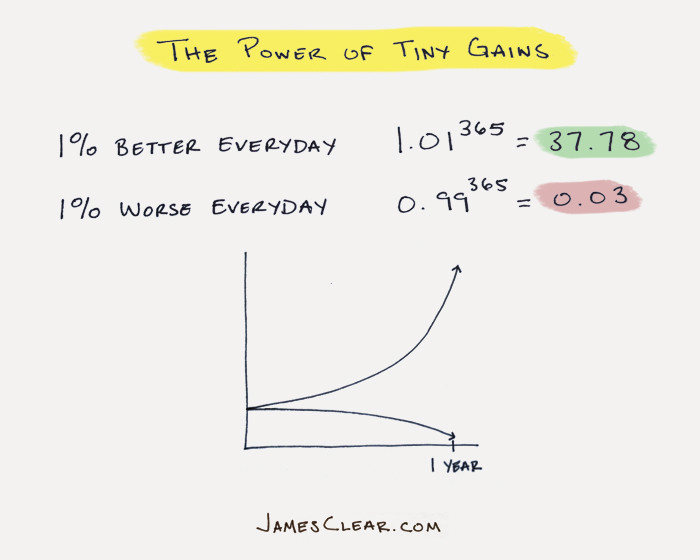

The Power of Tiny Gains: Small Steps, Big Results

The idea of making significant progress often seems daunting. We tend to focus on grand gestures and ambitious goals, overlooking the power of small, consistent steps. However, the accumulation of tiny gains over time can lead to extraordinary results. The Compound Effect The concept of compounding is not just limited…